capital gains tax usa

Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. Recent tax reform changes are suggesting that long-term capital.

Capital Gains Tax In The United States Wikipedia In 2021 Capital Gains Tax Capital Gain Financial Tips

The long-term capital gains tax rate is 0 15 or 20 depending on your taxable income and filing status.

. Understand capital gain tax in the US. The long-term capital gains tax rates are 0 percent 15 percent and 20 percent depending on. Most of the time the tax rate on capital gains is much lower than on ordinary income.

They are generally lower than short-term capital gains tax rates. The rates are much less onerous. The highest-earning people in the United States pay a 238 tax on.

Many people qualify for a 0 tax rate. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Long-term capital gains tax rates typically apply if you owned the asset for more than a year.

Long-term capital gains tax is a tax applied to assets held for more than a year. Long-term gains are taxed at lower rates up to 20 percent. There are a few other exceptions where capital gains may be taxed at rates greater than 20.

Ad Invest capital gains from past investments to defer and your federal tax bill. Capital gains tax is the tax you pay after selling an asset that has increased in value. The current long-term capital gains rate is based on income brackets but is generally anywhere between zero and 20 percent.

At the state level income taxes on capital gains vary from 0 percent to. Assets subject to capital gains tax include stocks real estate cryptocurrency and. Eliminate your capital gains taxes by investing in Origin Investments QOZ Fund II.

Source capital gains in the hands of nonresident alien individuals physically present in the United States for 183 days or more during the taxable. Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax rate up to 37 for 2022. Long-term capital gains attract a 10 tax above Rs.

The US tax rates applicable to long term capital gain gain on capital property owned for more than 12 months are generally 15 or 20 there are technically 3 tax brackets on capital gains. In most cases the US taxes capital gains at either 15 or 20 after an tax free amount which increases each year for inflation 40000 of gains for a single filer in 2020. Yes you might qualify for a reduced exclusion that would be much better than no exclusion at all.

Even taxpayers in the top income tax bracket pay long-term capital gains rates. Gains shall be added to your income and tax shall be applicable according to the income. 1 lakh applicable surcharge and education cess.

4 rows The capital gains tax on most net gains is no more than 15 for most people. 4 rows If you realize long-term capital gains from the sale of collectibles such as precious metals. In addition to federal taxes on capital gains most states levy income taxes that apply to capital gains.

If your taxable. A flat tax of 30 percent was imposed on US. The taxable part of a gain from selling section 1202 qualified small business stock is.

Short-term capital gains are taxed as ordinary income at rates up to 37 percent. Includes short and long-term Federal and State Capital. Taxpayers with modified adjusted gross income.

Here S The Formula For Paying No Federal Income Taxes On 100 000 A Year Marketwatch Federal Income Tax Income Tax Income

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

State And Local Sales Tax Rates 2013 Income Tax Map Property Tax

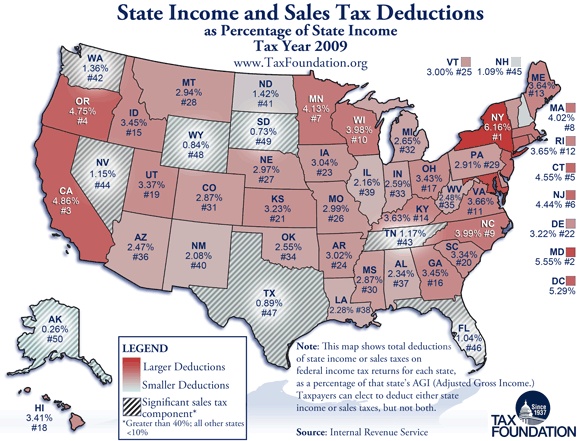

State And Local Tax Deductions Data Map American History Timeline Map Diagram

Monday Map State Income And Sales Tax Deductions Data Map Map Map Diagram

Paul Ryan Budget Business Insider Capital Gains Tax Budgeting Income Tax Brackets

Capital Gains Tax Capital Gain Integrity

How High Are Capital Gains Tax Rates In Your State Capital Gains Tax Capital Gain Finance Jobs

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

Sales Taxes In The United States Wikipedia The Free Encyclopedia Capital Gains Tax Sales Tax Tax

How Much Can We Earn In Retirement Without Paying Federal Income Taxes Early Retirement Now Federal Income Tax Income Tax Capital Gains Tax

How Far Will Dollar Stretch Real Value Of 100 In Each State Revealed Map Usa Map Historical Maps

Pin By Brian On Mining Tax Deductions Financial Advice Tax Questions

Different Types Of Taxes We Pay In The Us If You Want To Know What Types Of Taxes Americans Have To Pay Scro Types Of Taxes Payroll Taxes Capital Gains Tax

Federal Mineral Royalty Disbursements To States And The Effects Of Sequestration Infographic Map Map Teaching Geography

Sales Tax Rate By State Income Tax Map Property Tax

Taxation In Australia Wikipedia Capital Gains Tax Income Tax Return Payroll Taxes

The Richest Person In Every Us State Vivid Maps Wealthy Map Person