nd tax commissioner payment

North Dakota property tax is determined by multiplying the taxable value of real property -- land and buildings -- by the local mill rate. Pay Property Tax On-Line Its simple secure and easy to implement Questions about paying your taxes online please contact.

North Dakota Governor Looking For Tax Commissioner Appointee Govt And Politics Bismarcktribune Com

No matter what method you use to file tax preparer software you purchase or one of.

. Sally Whittingham 205 Owens Street Manning ND 58642. Prepaid Wireless 911 Fee Forms. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view payments edit contact information and more.

PAYMENT AND COLLECTION OF TAXES 57-20-01. Motor Fuel Tax Forms. Tax receipts filed with county auditor - Copies retained.

Failure to file any statement or pay any applicable tax or minimum tax filing fee by the date required subjects the company. Income Tax Withholding Forms. This allows you to file and pay both your federal and North Dakota income tax return at the same time.

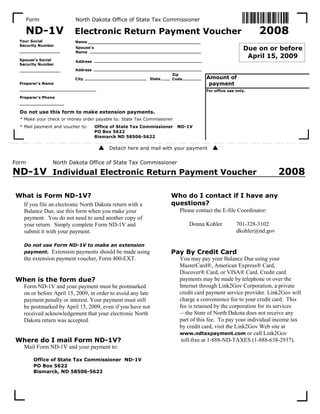

The tax commissioner shall annually calculate the amount of credit to which a company is entitled under this section. Oil and Gas Severance Tax Forms. Office of State Tax Commissioner PO Box 5622 Bismarck ND 58506-5622 Form ND.

Items Subject to Use Tax Line 4 on return Enter the total. The North Dakota Office of State Tax Commissioner partners with Fidelity National Information Services FIS an authorized IRS payment processor to provide online tax payment. To make an on-line tax payment click on the Research or Pay Property Taxes button below.

North Dakota individual income. You will need to have your property address statement number or parcel. Individual Income Tax Forms.

Local Option Sales and Use Tax refer to the North Dakota Sales And Use Tax Guideline for Local Option Taxes by Location. Estimated tax payments must be sent to the North Dakota Department of Revenue on a quarterly basis. We last updated the Estimated Income Tax - Individuals in February 2022 so.

Proof of payment for deliveryinstallation. You may be required to pay estimated income tax to North Dakota if you are required to pay federal estimated income tax and you expect your North Dakota net tax liability to be more. North Dakota Taxpayer Access Point ND TAP is an online system taxpayers can use to submit electronic returns and payments to the Office of State Tax Commissioner.

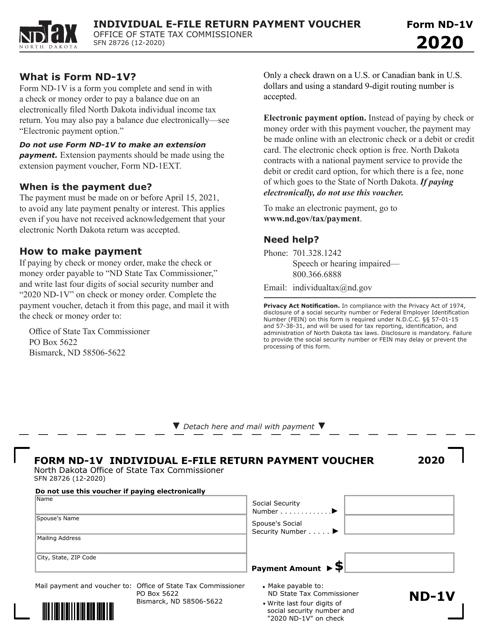

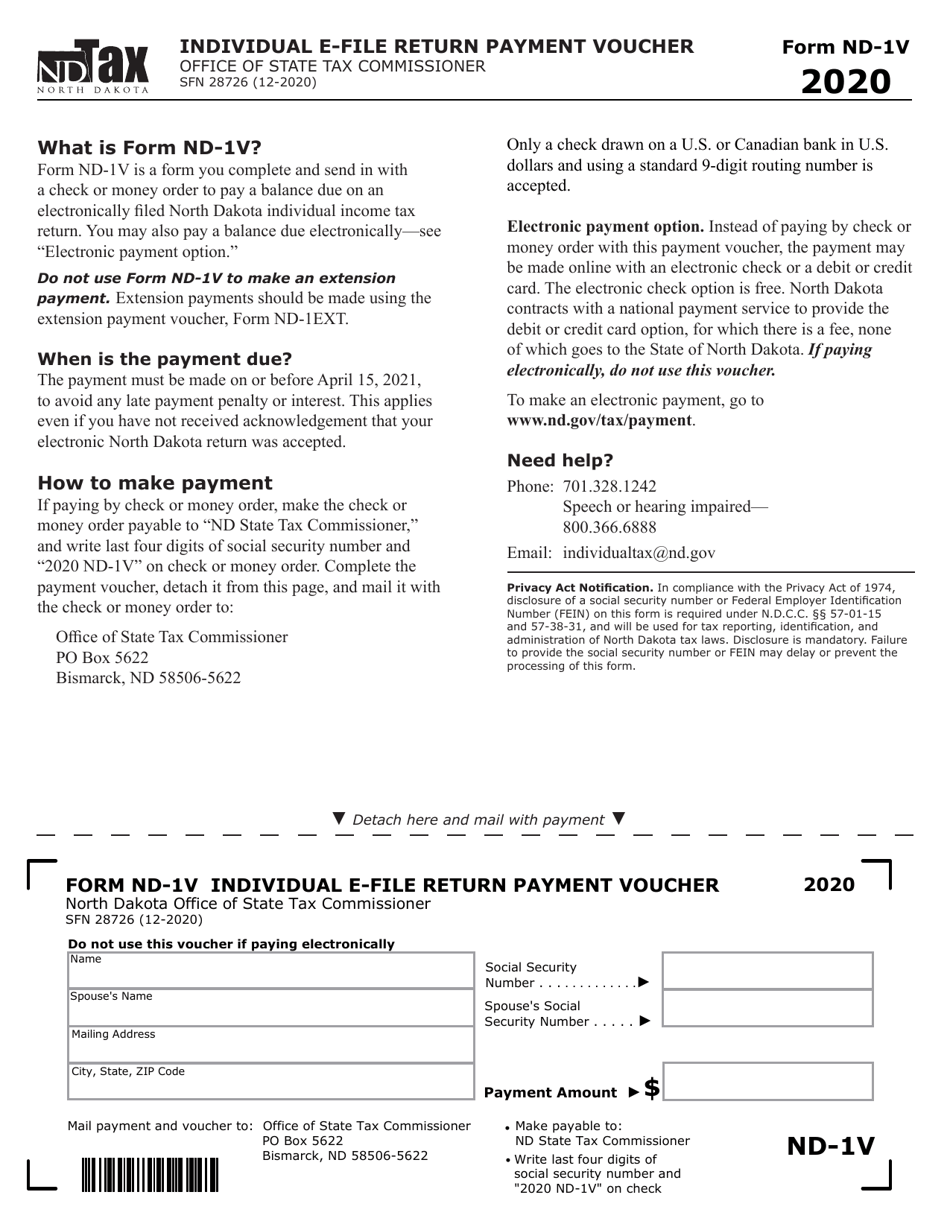

Complete the payment voucher detach it from this page and mail it with the check or money order to.

Fillable Online Nd North Dakota Office Of State Tax Commissioner One Time Remittance Form Please Check Appropriate Return See Page 2 For Instructions For Office Use Only Voluntary Sales And Use Tax

Ndtax Department Ndtaxdepartment Twitter

Form Nd 1v Sfn28726 Download Fillable Pdf Or Fill Online Individual E File Return Payment Voucher 2020 North Dakota Templateroller

North Dakota Office Of State Tax Commissioner Facebook

Income Tax Season Opens In North Dakota Minnesota Inforum Fargo Moorhead And West Fargo News Weather And Sports

North Dakota Office Of State Tax Commissioner Facebook

Mark Fox Director Three Affiliated Tribes Tax Commission Linkedin

North Dakota Office Of State Tax Commissioner Facebook

Ndtax Department Ndtaxdepartment Twitter

Ryan Llc Helps Companies Get Rich With Questionable Tax Refunds

Nd State Tax Commissioner Ryan Rauschenberger Am 1100 The Flag Wzfg

Nd Tax Commissioner Considering Action Against Griggs County Commission Kvrr Local News

Tax Commissioner Running In 2018 Two Long Serving State Legislators Are Not Prairie Public Broadcasting

Ryan Rauschenberger Archives Kvrr Local News

Form Nd 1v Sfn28726 Download Fillable Pdf Or Fill Online Individual E File Return Payment Voucher 2020 North Dakota Templateroller

Bill Of Rights Nd Gov Tax Indincome Forms 2008

Office Of State Tax Commissioner Cory Fong Tax Commissioner Ppt Download

Psc S Kroshus Is Appointed Nd Tax Commissioner Knox News Radio Local News Weather And Sports