how to calculate taxes taken out of paycheck in illinois

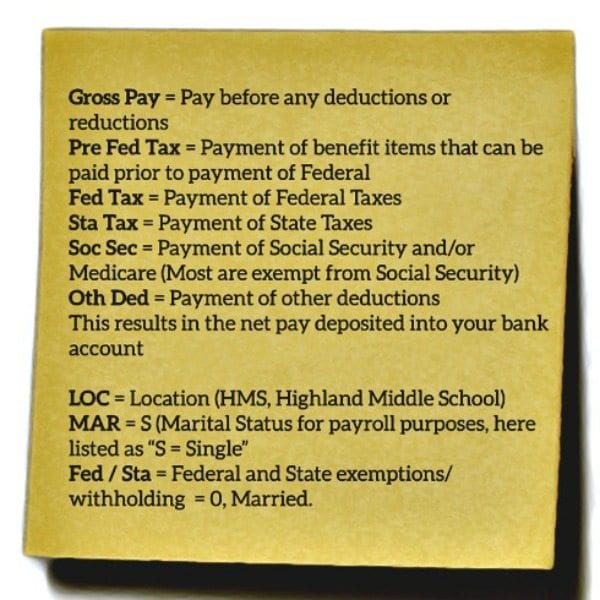

Your tax filing status. If your employees have 401 k accounts flexible spending accounts FSA or any other pre-tax withholdings subtract them from gross wages.

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings.

. Total annual income Income tax liability Payroll tax liability Pre-tax deductions Post-tax deductions Withholdings Your paycheck. When you start a new job you fill out a W-4 form to tell your employer how much to withhold from your check. Total Estimated Tax Burden 27857.

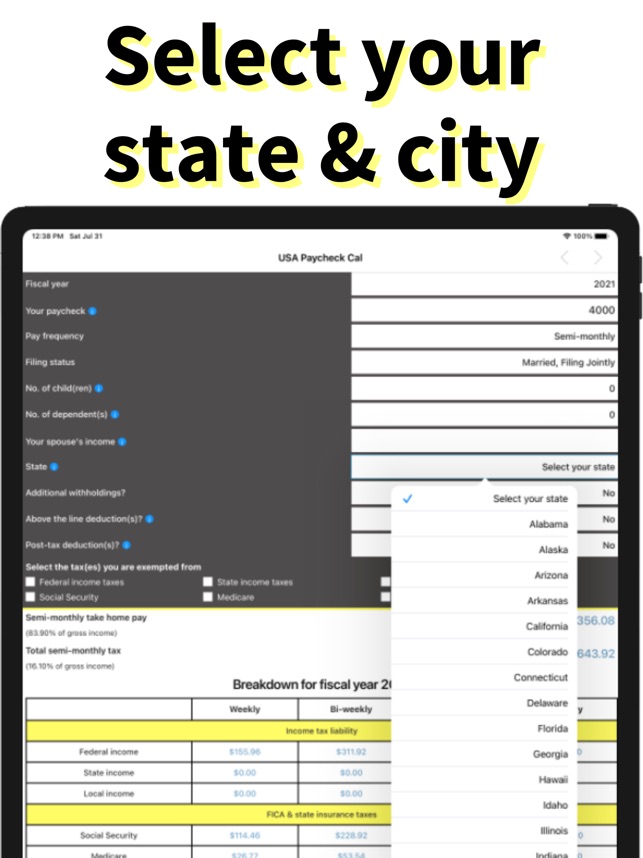

Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Employers in Illinois must deduct 145 percent from each employees paycheck. The Illinois Paycheck Calculator is designed to help you understand your financial situation and determine what you owe in taxes.

How much is 90k after taxes in Illinois. By placing a 0 on line 5 you are indicating that you want the most amount of tax taken out of your pay each pay period. Percent of income to taxes 37.

Once you have worked out your total tax liability you minus the money you put aside for tax withholdings every year if there is any and any post-tax deductions. How much is 75k after taxes in Illinois. The bonus tax calculator is state-by-state compliant.

The Illinois salary calculator will show you how much income tax is taken out of. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The Illinois state income tax is a flat rate for all residents.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. The federal withholding tax has seven rates for 2021.

If you wish to claim 1 for yourself instead then less tax. Work out your adjusted gross income Net. For the employee above with 1500 in weekly pay the.

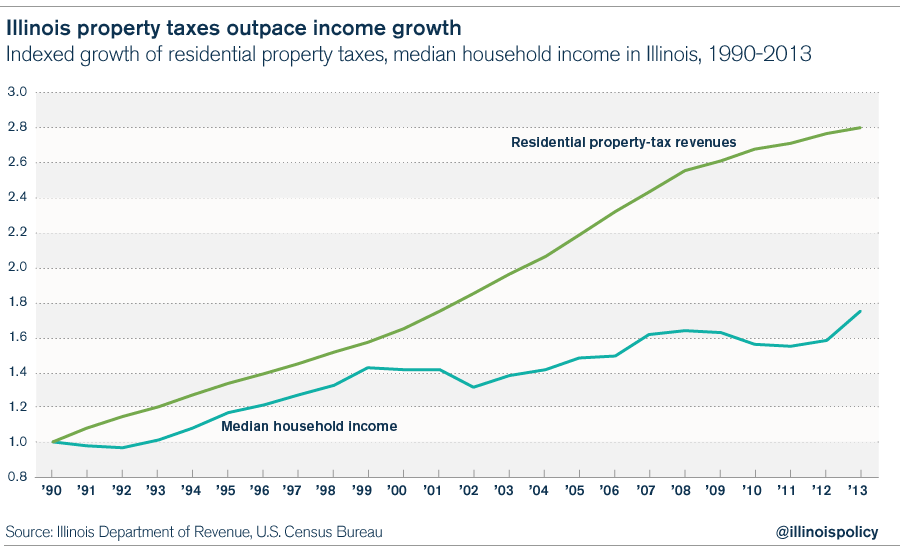

To estimate your real estate taxes you merely multiply your homes assessed value by the levy. Personal Income Tax in Illinois. Illinois tax is calculated by identyfying your taxable income in Illinois and then applying this against the personal income tax rates and thresholds identified in the Illinois state tax tables.

Employees who file for. Supports hourly salary income and multiple pay frequencies. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

Yes Illinois residents pay state income tax. Unlike Social Security all earnings are subject to Medicare taxes. 10 12 22 24 32 35 and 37.

Personal income tax in Illinois is a flat 495 for 20221. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Your number of personal exemptions.

Figure out your filing status. Although you might be tempted to take an employees earnings and multiply by 495 to come to a. The Illinois Paycheck Calculator uses Illinois.

Calculating your Illinois state income tax is similar to the steps we listed on our Federal paycheck calculator. This Illinois bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. How do I figure out the percentage of taxes.

Overview of illinois taxes illinois has a flat income tax of 495 which means. The federal withholding tax rate an employee owes depends on their income level. The Illinois bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Calculate any pre-tax withholdings. Created with Highcharts 607. This free easy to use payroll calculator will calculate your take home pay.

How much taxes is taken out of a paycheck in Illinois. Illinois Hourly Paycheck Calculator. Our income tax calculator calculates your.

Divide this number by the gross pay to determine the percentage of taxes. The illinois paycheck calculator will calculate the amount of taxes taken out of your paycheck. So if your home is worth 200000 and your property tax rate is 4 youll pay about.

But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. Just enter the wages tax withholdings and other information required.

Llc Tax Calculator Definitive Small Business Tax Estimator

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Payroll Tax Calculator For Employers Gusto

Gas Tax Rates By State 2021 State Gas Taxes Tax Foundation

How Many Tax Allowances Should I Claim Community Tax

Understanding Your Teacher Paycheck We Are Teachers

Are Pensions Taxable In Illinois

/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

Illinois Hourly Paycheck Calculator Gusto

Illinois Retirement Tax Friendliness Smartasset

What Taxes Are Taken Out Of A Paycheck In Illinois

![]()

Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay

Illinois Payroll Services And Regulations Gusto Resources

How Many Tax Allowances Should I Claim Community Tax

![]()

Illinois Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Illinois Paycheck Calculator Adp

Home Is Where The Hurt Is How Property Taxes Are Crushing Illinois Middle Class